How do you create passive income while you sleep?

Dividend Investing pays you money just for owning a company’s stock.

Watch your investments grow 24/7 with the power of compound interest.

In today’s email:

What is Dividend Investing?

How to make money with Dividend Investing

Final Thoughts

👇Watch: Ready to Start A Side Hustle? Watch my YouTube channel below.

TOP STORY

🤑 What is Dividend Investing?

Dividend Investing is a powerful investment strategy that makes you extra money just by owning a companies stock.

A dividend is basically a company saying, “Hey, we made so much profit this month/quarter we’re going to distribute the wealth to our shareholders”

The best part.. All you have to do is own a stock that pays dividends and they’ll do the rest — with the help of Charles Schwab, our brokerage.

*Disclaimer: This post is not financial advice and should be treated as informational only. I’m not qualified to provide any stock/trading/investment advice, just share my personal experiences.

PARTNERSHIP - Every Click Supports Mattox Minute 👇

We personally vet each of our sponsors to ensure you are getting a high quality product/service from our recommendations.

Yes, Ads can be annoying but we promise we won’t spam you on purpose ♥️

⭐ Roku Ads Manager finds an audience that converts by utilizing A/B testing for your ads — if you want to increase your revenue don’t sleep on this one.

⭐ Belay provides remote staffing opportunities to companies both large & small — if you’re looking to hire someone I’d start with them.

⭐ Guidde creates stunning training videos with a couple clicks by leveraging the power of AI — definitely check these guys out.

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

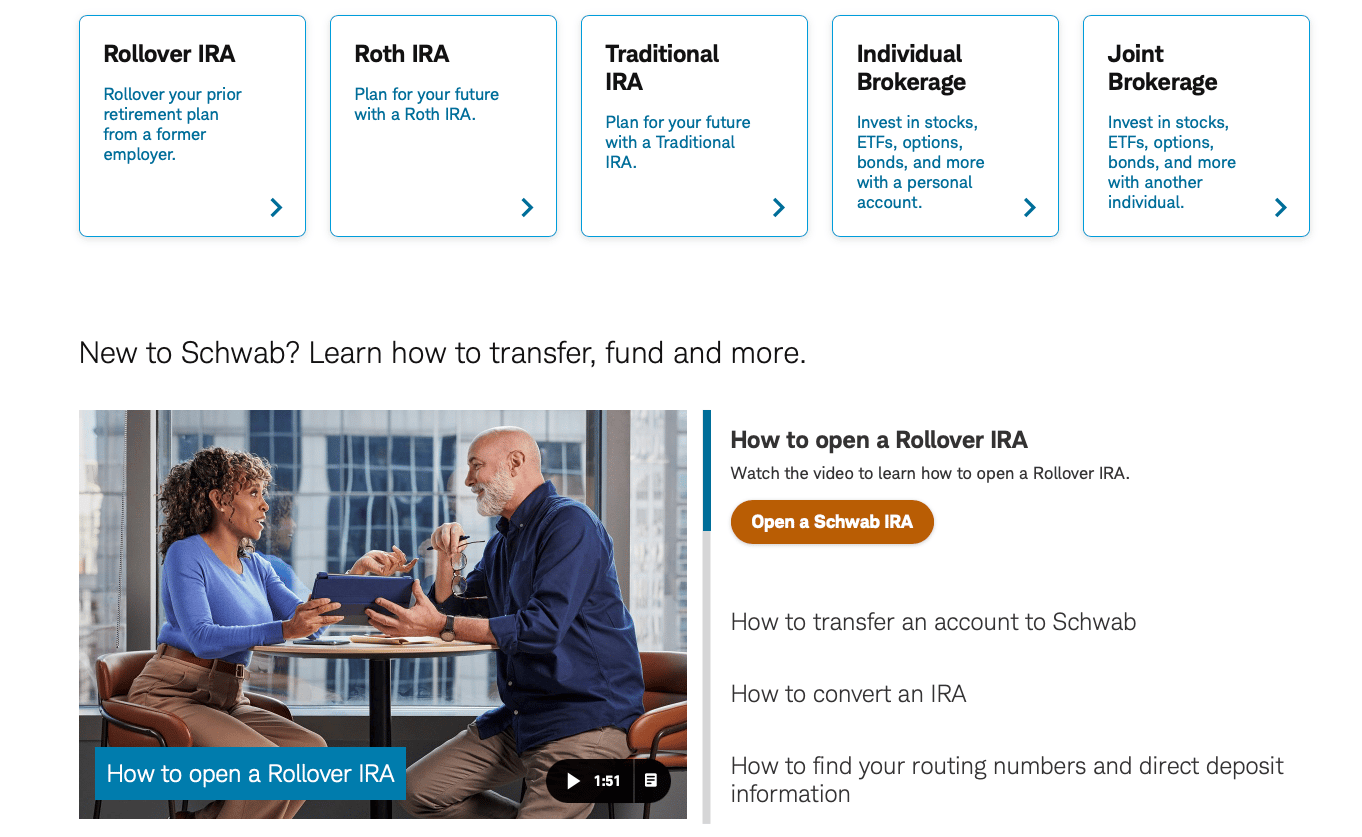

1. How It Works — Setting Up Brokerage Account

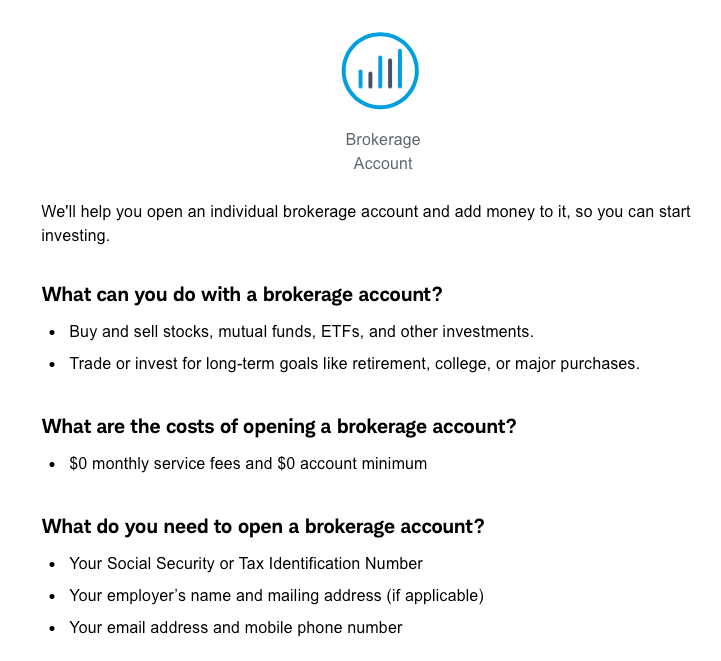

The first thing you’ll want to do is setup a free brokerage account at Charles Schwab.

If you’re brand new to investing and have no idea where to start. Don’t worry you’re not alone!

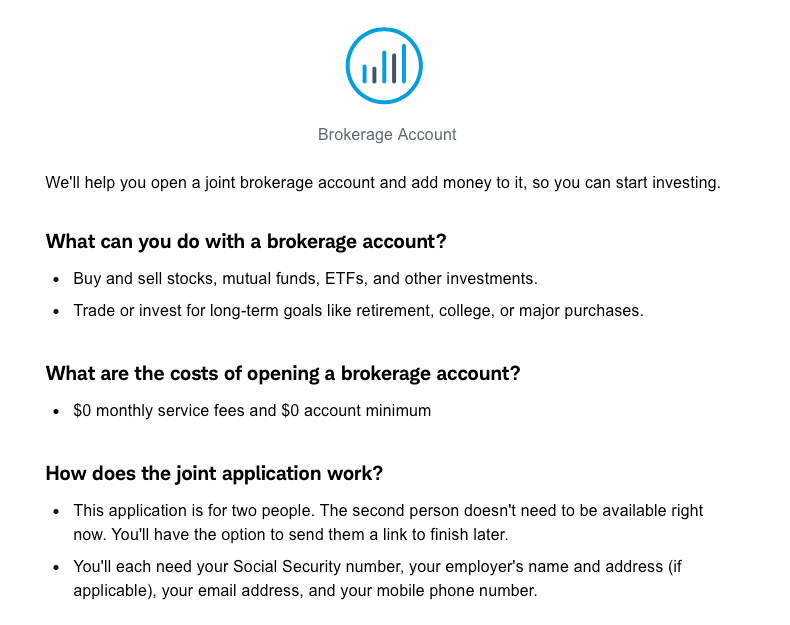

Schwab has a couple different accounts you can choose to open:

Rollover IRA - Rollover an existing retirement account from former employer

Roth IRA - Pay taxes now so you can take money out later tax-free

Traditional IRA - Investment account you can write off your contributions now

Individual Brokerage - Investment account you setup by yourself

Joint Brokerage - Investment account you setup with your spouse

2. How To Deposit Money

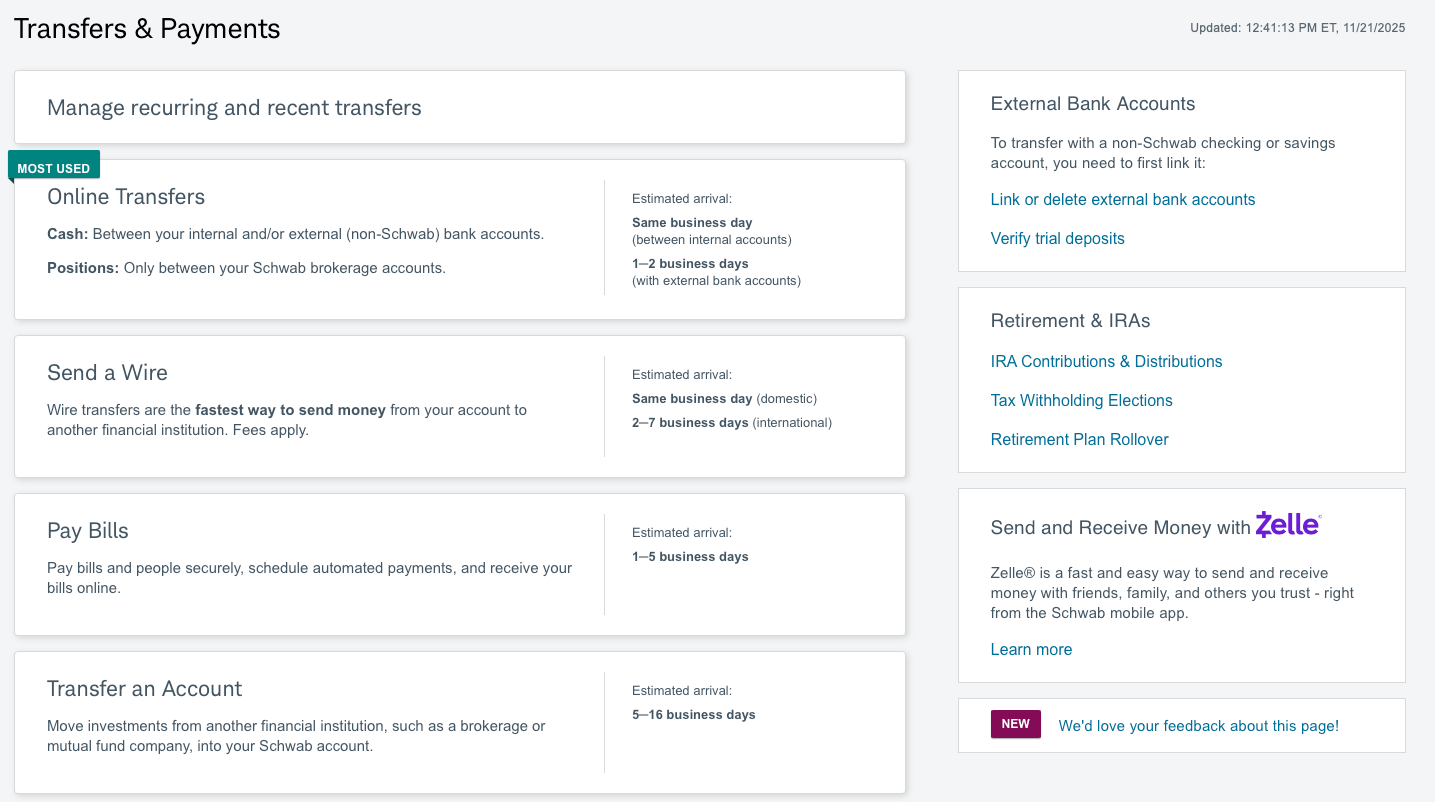

After you setup your account, you’re going to want to link your bank account in order to deposit money into your investment (brokerage) account.

Schwab has multiple ways to transfer money into your account.

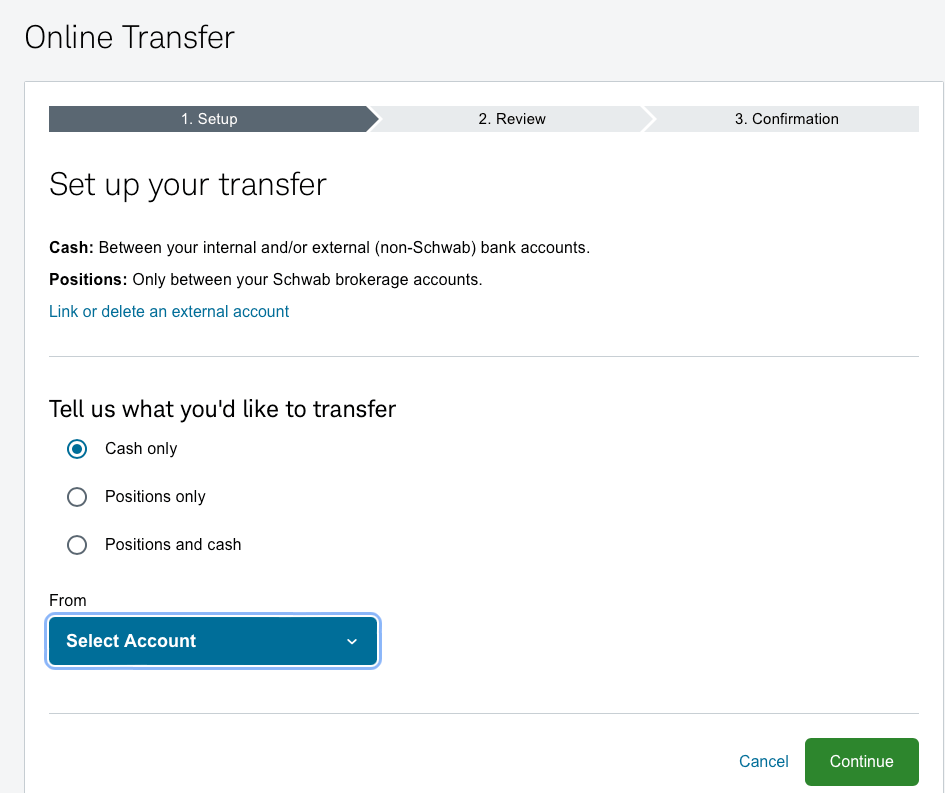

The easiest way I’ve found is to use the Online Transfers option and once you link your external bank account you can setup recurring money transfers to your investment account or you can deposit one-time payments.

Setting up your transfer is very easy, just select the bank account you want to transfer the money from and then select which brokerage account you want the money to go into.

Here you can choose do you want to transfer cash only, or positions (stocks) from account to account.

Typically when you’re first starting out you’ll want to transfer cash only until you build up your investment account.

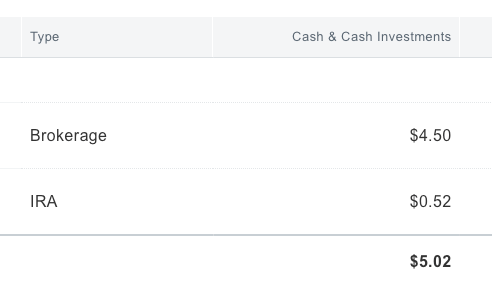

Once you deposit money you’ll be able to see that dollar amount in the available to use in your individual accounts.

3. How To Choose Dividend Stocks

So, how do you actually choose stocks that will pay you monthly/quarterly?

There are couple ways to do this:

Invest in companies you like

Search Google for highest paying dividend stocks

Use Schwab’s Research Tools to help you decide

Ask ChatGPT what are the highest paying dividend stocks/ETF

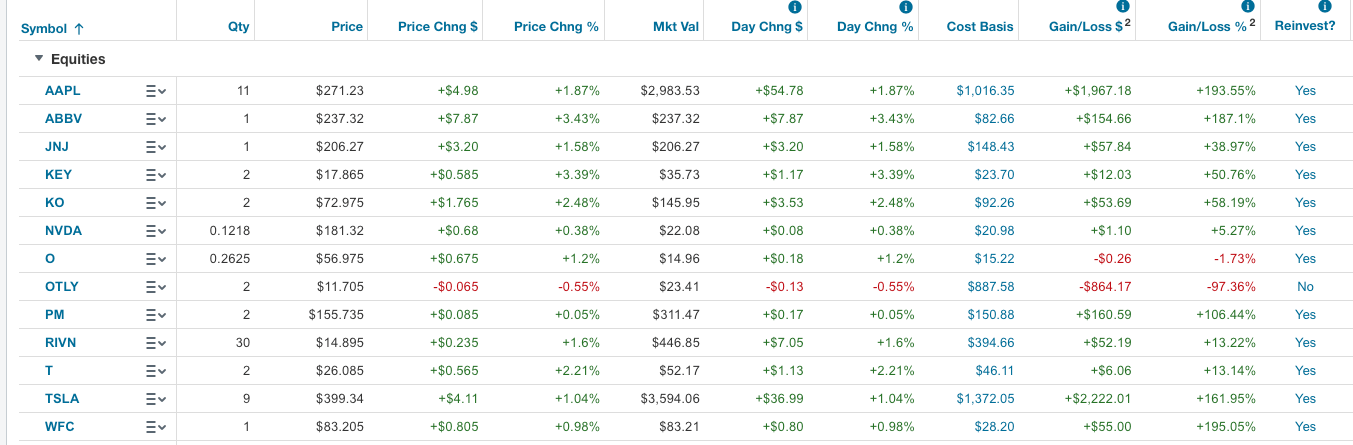

My Dividend Stocks

I want to share with you guys the stocks I’ve chosen over the years that pay dividends.

The amount varies but these have all paid pretty consistently either monthly/quarterly.

Out of all of my dividend stocks, I would say Apple, Philip Morris and Johnson & Johnson pay the highest dividends consistently.

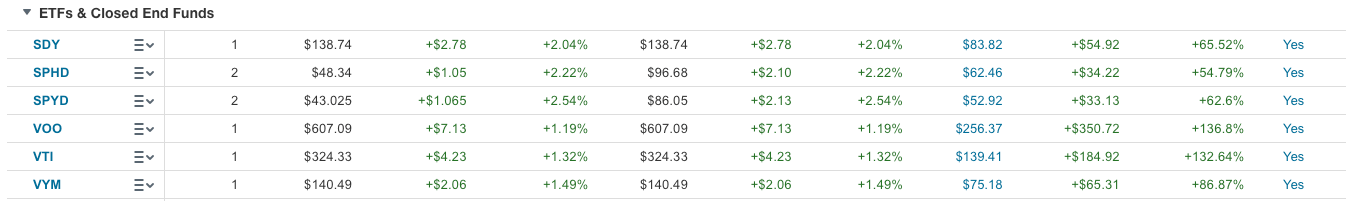

I also have ETF’s or Exchange Traded Fund’s that pay dividends.

These are basically a combination of multiple companies wrapped into one stock.

The top 2 ETF’s I would recommend are VOO and VTI.

VOO - The Vanguard S&P 500 ETF is an exchange-traded fund (ETF) that tracks the S&P 500 index, a stock index containing about 500 of the largest publicly traded companies in the U.S.

VTI - The Vanguard Total Stock Market ETF holds the Top 10 Highest Performing Companies:

NVIDIA Corp

Microsoft Corp

Apple Inc

Amazon.com Inc

Broadcom Inc

Alphabet Inc (Class A)

Meta Platforms Inc

Alphabet Inc. (Class C)

Tesla Inc

Berkshire Hathaway Inc. (Class B)

Drowning in Details? Here’s Your Life Raft.

Stop doing it all. Start leading again. BELAY has helped thousands of leaders delegate the details and get back to what matters most.

Access the next phase of growth with BELAY’s resource Delegate to Elevate.

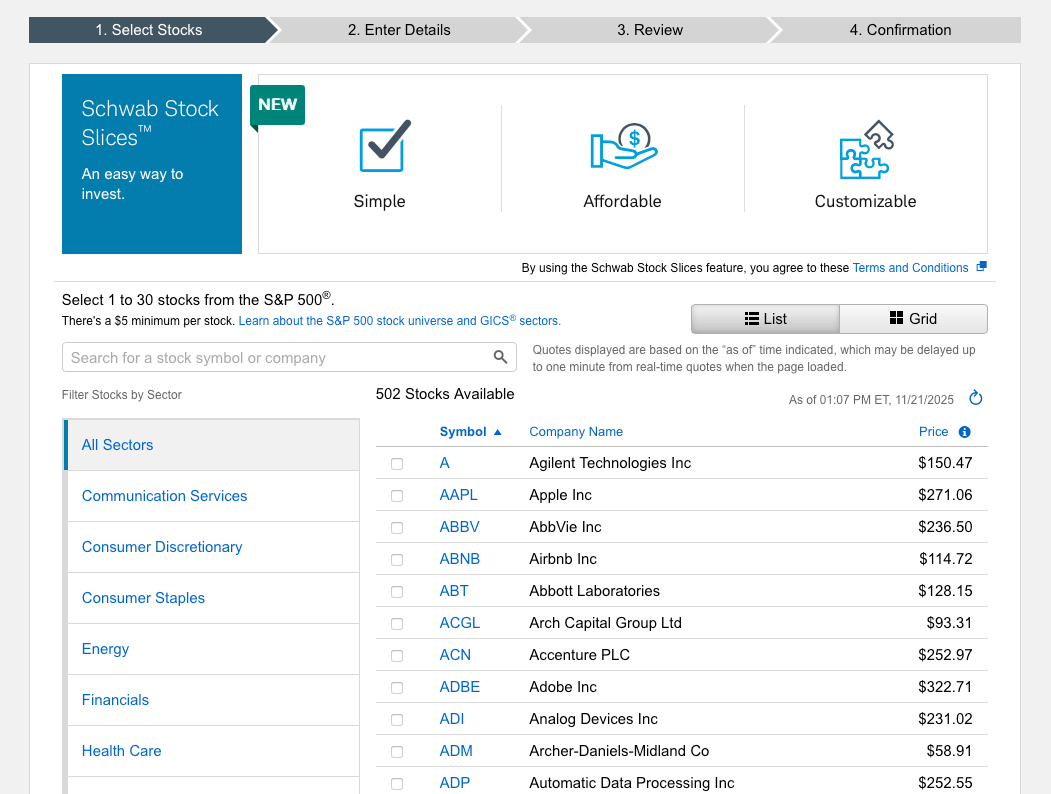

4. Schwab Stock Slices

If you aren’t able to afford an entire stock price, Schwab gives you the opportunity to purchase a slices or piece of a stock.

This allows you to still own a part of a company without having to invest in the total price if it’s too expensive.

You can choose from up to 30 stocks in the S&P 500 to purchase the Schwab Slice.

You’ll just need to purchase $5 minimum of any stock listed and you’ll own a fractional share of the company.

You can still take advantage of their dividends however the payout most likely will be much less depending on how much of the stock you own.

5. Setup DRIP - Dividend ReInvestment Program

Once you purchase a stock you’ll see an option to ‘Reinvest Dividends’.

By selecting this any money you make will automatically be reinvested back into the same stock.

Schwab’s DRIP program uses the power of compound interest to multiple your investments & increase your wealth automatically.

From Boring to Brilliant: Training Videos Made Simple

Say goodbye to dense, static documents. And say hello to captivating how-to videos for your team using Guidde.

1️⃣ Create in Minutes: Simplify complex tasks into step-by-step guides using AI.

2️⃣ Real-Time Updates: Keep training content fresh and accurate with instant revisions.

3️⃣ Global Accessibility: Share guides in any language effortlessly.

Make training more impactful and inclusive today.

The best part? The browser extension is 100% free.

🔥 Final Thoughts

Dividend Investing can seem overwhelming at first, that’s okay.

Take your time and do your own research on which stocks will make you the most money when reinvested in.

Schwab’s platform makes investing very easy from the beginner to the advanced investor.

Stay tuned, we have 3 more Lazy Side Hustles coming in the coming weeks!

👉 Hit ‘Reply’ and let me know, Will you try the Dividend Investing Side Hustle?